Related Topics: no annual fee

If you are a cost-conscious traveler, then the Bank of America Travel Rewards® Card is the ideal card for you. This is a rewards card tailored for users who travel from time to time, and with no annual fee, no foreign transaction fee or expiration on points, you can conveniently rack up reward points at your own pace.

Bank of America Unlimited Cash Rewards credit card is best for people who prefer straight cashback without dealing with spending categories. It lets you earn 1.5% straightforward cash rewards on all purchases, including gasoline, grocery, travel, dining, utilities, and more. It offers a bounty of $200 bonus cash. Furthermore, Bank of America Unlimited Cash Rewards credit card has no annual fee and features 0% introductory interest. In conclusion, these benefits make Bank of America Unlimited Cash Rewards credit card an ideal cash back credit card to use for everyday purchases.

With no annual fee and an easy-to-understand rewards structure, Bank of America Customized Cash Rewards credit card is a great payment card that is best for people who want to get more cash back on the things you buy every day. If you are already a Bank of America customer and maintain accounts with a high balance of $100,000 or more, you can use this credit card to earn top-tier cash rewards of up to 5.25% back, which makes it one of the highest cash back credit cards.

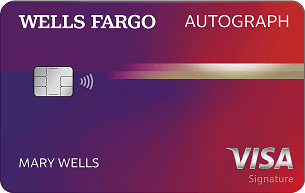

If you're on the lookout for substantial credit card rewards, consider enrolling in the Wells Fargo Autograph Card. As the newest addition to Wells Fargo's lineup of consumer credit cards, this card stands out as a valuable choice for individuals seeking an everyday rewards card. With no annual fee, it proves to be an appealing option for those mindful of their budget. The card boasts 3% points accrual rates for dining, gasoline, travel, and transportation expenses. Furthermore, the Wells Fargo Autograph Card offers a noteworthy sign-up bonus of 30,000 points, a $300 cash redemption value, adding to its allure as a rewarding credit card option.

If you have good credit and are looking for a credit card with no annual fee, you can qualify for many cash back or travel credit cards that let you earn rewards on everyday purchases.

Several credit cards offer bonuses to people who eat out a lot, thanks to bonus points on restaurant spending. Which cards offer the most generous rewards dining purchases? Quite a few credit cards offer a lot of bonus and rewards while charging no annual fee. If you want more rewards and bonus on dining, or just want straightforward cash rewards, there is a card for you.

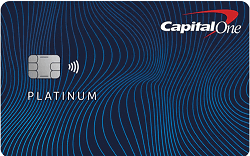

If you have average or fair credit, Capital One Platinum Credit Card is a good credit card to build credit without having to pay an annual fee. It is an unsecured card which means that you don't need to make a security deposit. It is a Mastercard that can be used almost everywhere. As long as you make payments on time, this card will be the perfect tool to establish credit.

If you are looking for a credit card with easy cash rewards, Citi Double Cash Card is a credit card that gives you $200 bonus cash back and essentially 2% cash back on everything. It is a Mastercard that lets you earn unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. It has no annual fee and offers 0% intro APR on balance transfers for 18 months.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don't come with a yearly charge.

Credit cards with no annual fee give responsible users a payment tool at no cost. At the same time, they allow people to accumulate cash back, earn points, receive bonus, or even receive perks such as free flights or hotel stays. Check out some of the best no annual fee credit cards for consumers and small businesses.