Overview

If you like to earn steady cash rewards, look no further than Bank of America® Unlimited Cash Rewards credit card. It is a no-annual-fee credit card that awards cardholders flat 1.5% cash back on all purchases. In addition, Bank of America Unlimited Cash Rewards credit card gives out a $200 sign-up bonus after you make qualified purchases. Plus, you can enjoy 0% interest on purchases and qualifying balance transfers for 15 billing cycles.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don't expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that's currently 19.24% - 29.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

- Intro APR

- 0% on Purchases and qualifying Balance Transfers

- Intro APR Period

- 15 billing cycles

- Annual Fee

- $0

- Credit Needed

- Excellent / Good

Card Benefits

$200 Cash Back Bonus

Cardholders of Bank of America Unlimited Cash Rewards credit card will earn $200 cash bonus after spending $1,000 in the first 90 days of account opening. Earning the $200 bonus is like getting a 20% discount on your first $1,000 in purchases. It is an easy way to put more cash back in your pocket.

Cash Rewards

In addition to the welcome bonus, you will earn cash back rewards everywhere you go. Bank of America Unlimited Cash Rewards credit card pays you unlimited 1.5% flat-rate cash back on purchases. For your cash rewards, there are no rotating spending categories to keep track of. There is no limit to the amount of cash back you can earn and your rewards never expire as long as your account remains open. You can redeem your cash back for any amount, anytime for statement credits and deposits made directly into your Bank of America checking or savings account.

For example, if you spend $30,000 on the card in a year, you will receive $450 cash back rewards. You can use our cash rewards calculator to find out how much cash back rewards you may receive.

| Spending on All Purchases | $30,000 |

| Cash Rewards (at 1.5% Cash Back) | $450 |

| Net Spending (after Cash Back) | $29,550 |

0% Interest for 15 billing cycles

Bank of America Unlimited Cash Rewards credit card lets you have 0% interest on purchases and qualifying balance transfers for 15 billing cycles. After the introductory period, the go-to rate of 19.24% - 29.24% variable applies.

With 0% intro APR on purchases, you can charge expensive purchases to the card now and pay off the balance 15 months later. As long as you make minimum payments shown on your credit-card statements every month, you will not have to pay any interest or fees for 15 months.

Furthermore, you can have 0% interest on balance transfers made in the first 60 days, which allows you to transfer existing balance of other credit cards to your new Bank of America Unlimited Cash Rewards credit card. In this way, you can save money on interest fees by paying off current credit-card balance now and then paying no interest for 15 months on the Bank of America Unlimited Cash Rewards credit card.

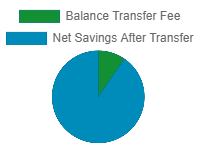

Savings on Balance Transfers

For each balance transfer, there is a one-time transaction fee of 3% of the amount of each balance transfer. The balance transfer fees of Bank of America Unlimited Cash Rewards credit card are among the lowest of balance-transfer credit cards.

For instance, if you carry a balance of $12,000 on a credit card that has an interest rate of 25%, you can sign up for a new Bank of America Unlimited Cash Rewards credit card to request a transfer to save about $3,390. The potential interest fees on the current credit-card balance is about $3,750 for about 15 months. And the transaction cost is $360 to do the balance transfer in the first 60 days. Therefore, the net savings is about $3,390. You can use our balance transfer calculator to find out how much you can save on balance transfers.

| Potential Interest for 15 months | $3,750.00 |

| Balance Transfer Fee | $360.00 |

| Net Savings | $3,390.00 |

Loyalty Bonus

If you are a Bank of America Preferred Rewards® customer, your rewards bonus can be between 25% and 75% of your base cash rewards. There are 3 tiers in the Preferred Rewards program: Gold, Platinum and Platinum Honors. Your tier is based on your qualifying combined balances in your Bank of America deposit accounts and/or Merrill investment accounts. Depending on your eligible tier of Preferred Rewards, you can get a 25%, 50% to 75% rewards bonus on the baseline rewards. The following chart shows the qualification requirement of minimum balance and rewards for Gold, Platinum, Platinum Honors tiers of Preferred Rewards.

| Preferred Rewards Tier | Rewards Bonus | Rewards for Bank of America Unlimited Cash Rewards credit card |

|---|---|---|

| Gold | 25% | 1.875% cash back for every dollar spent on all purchases |

| Platinum | 50% | 2.25% cash back for every dollar spent on all purchases |

| Platinum Honors | 75% | 2.625% cash back for every dollar spent on all purchases |

If you qualify for the Platinum Honors Tier of Preferred Rewards, and still spend the same amount as the above example, i.e., $30,000 on purchases, you will receive $787.50 cash rewards for the year. See the calculation of cash back rewards for preferred rewards.

| Spending on All Purchases | $30,000 |

| Cash Rewards (at 2.625% Cash Back) | $787.50 |

| Net Spending (after Cash Back) | $29,212.50 |

Free Museum Admission

Cardholders of any Bank of America credit cards have a unique perk of free admission to more than 200 museums on the first full weekend of every month. Bank of America has been running a program of Museums on Us for over two decades, which lets its customers enjoy free admission to over 200 museums on the first weekend each month. You can present your Bank of America Unlimited Cash Rewards credit card along with a photo ID to gain one free general admission to any of 200+ museum participants of the special Museums on Us program.

Visa Signature® Benefits

Bank of America Unlimited Cash Rewards credit card gives its card members access to Visa Signature® benefits automatically, such as 24-hour personalized concierge service when you travel, discounts at selected hotels, resorts and spas, travel and roadside assistance, etc. All of these perks are available at no additional cost to card members.

Fees

Bank of America Unlimited Cash Rewards credit card has no annual fee, which means there is no cost to keep the card. But for purchases that you make when you travel abroad, there are 3% foreign transaction fees. It is typical for no-annual-fee credit cards to have 3% surcharges on foreign purchases.

Required Credit Rating

Bank of America Unlimited Cash Rewards credit card is for people with good or excellent credit profile. If your credit score is above 700, you may qualify for the credit card.

Is this the right card for you?

Bank of America Unlimited Cash Rewards credit card is best for people who prefer straight cashback without dealing with spending categories. It lets you earn 1.5% straightforward cash rewards on all purchases, including gasoline, grocery, travel, dining, utilities, and more. It offers a bounty of $200 bonus cash. Furthermore, Bank of America Unlimited Cash Rewards credit card has no annual fee and features 0% introductory interest. In conclusion, these benefits make Bank of America Unlimited Cash Rewards credit card an ideal cash back credit card to use for everyday purchases.

Similar Credit Cards

If you are interested in the Bank of America® Unlimited Cash Rewards credit card, you may consider a few other credit cards with similar benefits.

Cash Back Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| Wells Fargo Active Cash® Card | $0 rates & fees | |

| Citi Double Cash® Card | $0 rates & fees | |

| Citi Custom Cash® Card | $0 rates & fees | |

| Bank of America® Customized Cash Rewards credit card | $0 | |

| Blue Cash Everyday® Card from American Express | $0 (rates & fees) | |

| Chase Freedom Unlimited® | $0 | |

| USAA Preferred Cash Rewards Credit Card | $0 (rates & fees) | |

Bonus Rewards

| Credit Card | Credit Card Bonus | Annual Fee | |

|---|---|---|---|

| Citi Strata Premier℠ Card | 70,000 bonus ThankYou Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com | $95 rates & fees |

| Wells Fargo Autograph℠ Card | 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value. | $0 rates & fees |

| Bank of America® Travel Rewards credit card | 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases. | $0 |

| Chase Sapphire Preferred® Card | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel. | $95 |

| Bank of America® Premium Rewards® credit card | Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening. | $95 |

0% Interest Credit Cards

| Credit Card | 0% Interest | Annual Fee | |

|---|---|---|---|

| Wells Fargo Reflect® Card | 0% on purchases and qualifying balance transfers for 21 months from account opening (rates & fees) | $0 |

| Citi® Diamond Preferred® Card | 0% on purchases for 12 months and on qualifying balance transfers for 21 months (rates & fees) | $0 |

| USAA Rate Advantage Credit Card | 0% on balance transfers for 15 months (rates & fees) | $0 (rates & fees) |