Related Topics: balance transfers

In January 2011, Discover Card introduced Discover More Card, featuring an unprecedented promotional balance transfer offer. New members were offered an exceptional 0% introductory APR on balance transfers, astonishingly lasting for 24 months. Initially available for over three months, this offer set a historical benchmark as the lengthiest 0% balance transfer promotion. While no other credit card has surpassed this record, several cards continue to present enticing deals of 21 months for individuals seeking to transfer high-interest balances.

Personal credit cards with no annual fee can be advantageous for a number of reasons. It saves cost because you won’t incur a yearly charge for simply having the card. No-annual-fee credit cards are often more accessible to a broader range of consumers. They typically come with straightforward terms. And they usually offer cash back rewards, sign-up bonuses, or 0% introductory APR. They can be excellent backup or secondary credit cards for occasional use.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 18.24% - 28.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

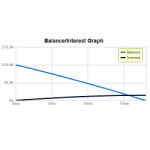

If you carry credit card debt, it may cost you a lot of money on the interest. Don't worry. Balance transfer credit cards can help you pay down the debt. Learn how to use balance transfer credit cards to reduce credit card balance and see how much you can save with 0% APR on balance transfers for an extended period.