Related Topics: no foreign transaction fees

Citi Strata Premier Card is a consumer credit card that offers rich bonus and generous rewards on everyday purchases. It gives new card members a bounty of $600 value, which is among the top sign-up bonus rewards that you may receive from a credit card. In addition, it offers 3 ThankYou rewards points for each dollar you spend in grocery, dining, travel, and gas, which are the most common purchases for most consumers.

Taking 10% discount off expensive hotel nights on your trips does not require any special coupons. If you have Citi Premier Card, you can automatically save 10% on hotel reservations made at Citi Travel Portal. In addition, you can enjoy a generous sign-up bonus, unlimited rewards on all purchases, and the benefits of paying no foreign transaction fees on your purchases overseas.

Costco is a warehouse for family and small business to make purchases in bulk. If you like to use Costco for many of your business purchases, Costco Anywhere Visa Business Card is great credit card. Although it does not offer a sign-up bonus, it offers business owners up to 5% cash back on gas purchases, 3% cash back on restaurants and travel purchases, and 2% cash back on all other purchases from Costco. In addition, the Costco Anywhere Visa Business Card has no annual fee with paid Costco membership and has no foreign transaction fees.

- Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

- Earn 10 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 Points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

Credit cards allow you to borrow money up to a pre-set limit for your purchases or balance transfers. Card issuers will charge interest if you do not pay off your full statement balance by the payment deadline. You will be charged for late fees if you miss payment due dates. The convenience of using credit cards as a payment option comes with the potential cost of fees and interest. But if you use credit cards properly, you can save money in many ways.

If you would like to earn big rewards on business travel, Bank of America® Business Advantage Travel Rewards World Mastercard® is an ideal no-fee business travel card for you. It offers you an opportunity to earn 3 points for every dollar on travel purchases. In addition, if you are a client of Preferred Rewards for Business, you may get up to a 75% rewards bonus on the base earn of every purchase, which means you may earn up to 2.62 points per dollar on all purchases. Plus, this credit card has no international transaction fees and no annual fee.

After decades in the workforce, retirees finally have freedom to choose how to spend their time. For most seniors, retirement is the ideal time to take on extended travel adventures, including international travel. Most consumer cards charge around 3% of purchase prices on foreign purchases. However, there are a few travel credit cards that waive foreign transaction fees. Just carry these credit cards and use them for purchases abroad, you will not incur the foreign transaction fees. In addition, some credit cards offer lucrative travel rewards or bonus.

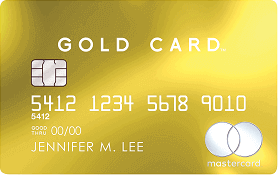

If you are looking for a credit card that is more than just amassing points, you should consider Mastercard® Gold Card, a premium credit card with unmatched benefits and luxury perks. Plated with 24-karat gold, the Mastercard® Gold Card is a very stylish metal credit card. It is a symbol of elite status. It comes with a steep annual fee, but it offers exclusive value that caters to successful business owners and professionals, such as 24/7 concierge services, rich rewards, and all-around exceptional benefits.