Overview

If you like earning steady cash rewards, look no further than Wells Fargo Active Cash® Card. It is a no-annual-fee credit card that awards cardholders unlimited 2% cash back on all purchases. There is no spending category restrictions or sign ups for rotating categories. Your cash rewards won’t expire as long as your account remains open. In addition, Wells Fargo Active Cash Card gives out a $200 cash rewards bonus after qualifying purchases. It also lets you enjoy 0% interest on purchases and qualifying balance transfers for 15 months from account opening.

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- Earn unlimited 2% cash rewards on purchases.

- 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 20.24%, 25.24%, or 29.99% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- $0 annual fee.

- No categories to track or remember and cash rewards don't expire as long as your account remains open.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Intro APR

- 0% on Purchases and qualifying Balance Transfers

- Intro APR Period

- 15 months from account opening

- Annual Fee (rates & fees)

- $0

- Credit Needed

- Good / Excellent

Card Benefits

$200 Cash Rewards Bonus

Cardholders of Wells Fargo Active Cash Card can earn $200 cash rewards bonus after spending $500 on purchases in the first 3 months. Earning the $200 cash rewards bonus is like getting a 40% discount on your first $500 in purchases. It is an easy way to put more cash back in your pocket.

Cash Rewards

In addition to the welcome bonus, you will earn cash back rewards everywhere you go. Wells Fargo Active Cash Card pays you unlimited 2% flat cash back on purchases. For your cash rewards, there are no rotating spending categories to keep track of and your rewards never expire. You can redeem cash rewards for paper checks, statement credits, or deposits to your eligible Wells Fargo checking or savings accounts.

How to Redeem Wells Fargo Active Cash Rewards

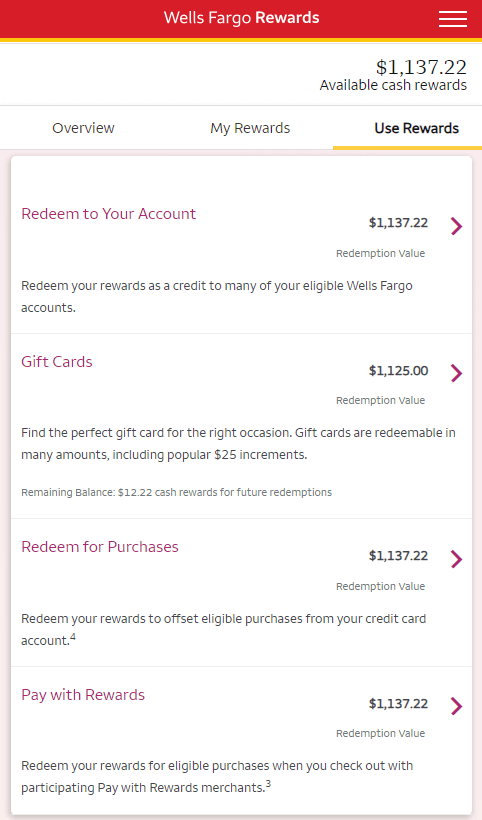

Wells Fargo Active Cash Card offers a versatile rewards redemption system, allowing cardholders to use their cash rewards in various ways, such as statement credits, gift cards, and travel. To redeem rewards, simply log in to your Wells Fargo credit card account online and navigate to the “Wells Fargo Rewards” link.

For statement credits, you can redeem your rewards up to the balance available. These credits can be applied to a Wells Fargo account of your choice, including your credit card, checking account, or mortgage. Similarly, when using rewards for purchases like flights, hotels, or merchandise, you can apply the full amount of your cash rewards.

Another option is redeeming rewards for gift cards from popular stores like Amazon, Apple, Home Depot, available in increments of $25. Occasionally, Wells Fargo may offer limited-time promotions, providing a 10% discount on select gift cards. For instance, if you have $22.50 in cash rewards, you can redeem it for a $25 gift card. As of November 2023, various shopping gift cards, including Apple, Home Depot, Macy’s, and McDonald’s, are available at a 10% discount.

To illustrate, if you have $1,137.22 in Wells Fargo cash rewards, you can choose to redeem the full amount for $1,137.22 in statement credits. Alternatively, if you opt for gift cards, you could redeem for $1,125 in gift cards, leaving $12.22 in your account. However, with the 10% discount on select gift cards, you can receive $1,250 in gift cards by using only $1,125, while still retaining the remaining $12.22. This rewards flexibility provides cardholders with options to maximize the value of their cash rewards.

0% Introductory APR

0% Interest for 15 Months

Wells Fargo Active Cash Card lets you have 0% interest on purchases and qualifying balance transfers for 15 months from account opening. After the introductory period, the go-to rate of 20.24%, 25.24%, or 29.99% Variable applies.

With the 0% intro APR on purchases, you can charge expensive purchases to the card now and pay off the balance 15 months later. As long as you make minimum payments shown on your credit-card statements every month, you will not have to pay any interest or fees for 15 months.

Furthermore, you can have 0% interest on balance transfers, which allows you to transfer existing balance of other credit cards to your Wells Fargo Active Cash Card. In this way, you can save money on interest fees by paying off current credit-card balance. And you can then pay no interest for 15 months on the Wells Fargo Active Cash Card.

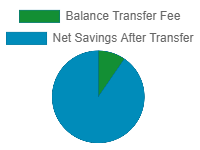

Savings on Balance Transfers

For each balance transfer, there is a one-time transaction fee. If you transfer balances within 120 days from account opening, the introductory balance transfer fee is 3% of the amount of each balance transfer, with a minimum fee of $5. After the 120-day introductory period, you pay up to 5% for each balance transfer, with a minimum of $5. The balance transfer fees of Wells Fargo Active Cash Card are among the lowest of balance-transfer credit cards.

For instance, if you carry a balance of $10,000 on a credit card that has an interest rate of 25%, you can sign up for a Wells Fargo Active Cash Card to request a balance transfer to save about $2,825. The potential interest fees on the current credit-card balance is about $3,125 for 15 months. And the transaction cost is $300 for the balance transfer in the first 120 days. Therefore, the net savings is about $2,825. You can use our balance transfer calculator to find out how much you can save on balance transfers.

| Potential Interest for 15 months | $3,125.00 |

| Balance Transfer Fee | $300.00 |

| Net Savings | $2,825.00 |

Additional Perks

Complimentary Cellular Telephone Protection

Cardholders can enjoy complimentary Cellular Telephone Protection provided by Wells Fargo, which reimburses account holders for damage to or theft of cell phones. Just use your Wells Fargo Active Cash Card to pay monthly cell phone bills, and you will get up to $600 of protection against covered damage or theft. It reimburses you for the cost of the repair or replacement of your original cell phone. You have a maximum benefit limit of $600 per claim, less a $25 deductible, and $1,200 per 12 month period.

24/7 Visa Signature Concierge service

Wells Fargo Active Cash Card offers a valuable perk with its 24/7 Visa Signature Concierge service. This feature allows cardholders to access a range of services for various needs. Whether you’re in search of tickets for top-tier sports and entertainment events, organizing travel plans, or making reservations for dinner, the concierge service is available to simplify these tasks and more. With this offering, cardholders can enjoy the convenience of a dedicated service ready to assist them around the clock, enhancing their overall experience with the Wells Fargo Active Cash Card.

Free FICO Score

Wells Fargo Active Cash Card offers an additional benefit with its complimentary Credit Close-Up tool. This resource empowers cardholders by providing the tools needed to understand and track their FICO Score. Upon enrollment, individuals gain access to monthly updates of their FICO Score, along with personalized insights into their credit. Notably, this valuable service comes at no cost for Wells Fargo Online customers, and using it does not adversely affect one’s credit score. This feature enhances the cardholder experience by promoting financial awareness and informed credit management.

Fees

Wells Fargo Active Cash Card has no annual fee, which means there is no cost to keep the card. But for purchases that you make when you travel abroad, there are 3% foreign transaction fees. It is typical for no-annual-fee credit cards to have 3% surcharges on foreign purchases.

Required Credit Rating

Wells Fargo Active Cash Card is for people with good or excellent credit profile. If your credit score is above 700, you may qualify for the credit card.

Is this the right card for you?

Wells Fargo Active Cash Card is best for people who prefer straight cashback without dealing with spending categories. It lets you earn 2% straightforward cash rewards on all purchases, including gasoline, grocery, travel, dining, utilities, and more. It offers a nice bounty of $200 cash rewards bonus after a mere $500 is spent on purchases in the first 3 months. Furthermore, Wells Fargo Active Cash Card has no annual fee and features 0% introductory interest. In addition, you will receive free Cellular Telephone Protection of up to $600 per claim for damaged or stolen cell phones. You will also have access to 24/7 Visa Signature Concierge and free FICO scores as additional perks. In conclusion, these benefits make Wells Fargo Active Cash Card an ideal cash back credit card to use for everyday purchases.

Similar Credit Cards

If you are interested in the Wells Fargo Active Cash Card, you may consider a few other credit cards with similar benefits.

Cash Back Credit Cards

| Credit Card | Cash Rewards | Annual Fee | |

|---|---|---|---|

| Citi Double Cash® Card | 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24. | $0 rates & fees |

| Bank of America® Customized Cash Rewards credit card | $0 | |

| Citi Custom Cash® Card | 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. | $0 rates & fees |

| Bank of America® Unlimited Cash Rewards credit card | $0 | |

| Chase Freedom Unlimited® | $0 | |

| Costco Anywhere Visa® Card by Citi | $0 rates & fees | |

Bonus Rewards

| Credit Card | Credit Card Bonus | Annual Fee | |

|---|---|---|---|

| Wells Fargo Autograph℠ Card | 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value. | $0 rates & fees |

| Citi Strata Premier℠ Card | 70,000 bonus ThankYou Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com | $95 rates & fees |

| Bank of America® Premium Rewards® credit card | Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening. | $95 |

| Chase Sapphire Preferred® Card | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel. | $95 |

| Bank of America® Travel Rewards credit card | 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases. | $0 |

0% Interest Credit Cards

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Wells Fargo Reflect® Card | 0% on purchases and qualifying balance transfers for 21 months from account opening (rates & fees) | $0 |

| Citi® Diamond Preferred® Card | 0% on purchases for 12 months and on qualifying balance transfers for 21 months (rates & fees) | $0 |

| Citi Rewards+® Card | 0% on purchases and balance transfers for 15 months (rates & fees) | $0 |