What is a Minimum Payment

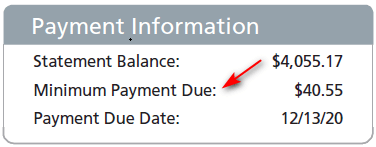

Many of you may have observed that the “Minimum Payment” section on your credit card bill is notably lower than the total bill amount. The convenience of owning a credit card lies in the ability to defer payment, akin to a loan, and settle the amount at a later date. However, to avoid penalty fees, a minimum payment must be made every month. This minimum payment represents the smallest amount you are obligated to pay on your credit card statement each month.

Many of you may have observed that the “Minimum Payment” section on your credit card bill is notably lower than the total bill amount. The convenience of owning a credit card lies in the ability to defer payment, akin to a loan, and settle the amount at a later date. However, to avoid penalty fees, a minimum payment must be made every month. This minimum payment represents the smallest amount you are obligated to pay on your credit card statement each month.

Credit card companies are mandated to establish the minimum payment to facilitate the reduction of your balance, assuming no additional charges are added to your balance. It serves as a mechanism to ensure that cardholders make regular payments, albeit at a reduced amount, contributing to the gradual reduction of their outstanding balance.

Minimum Payment Calculation

Each credit card company stipulates its minimum payment calculations in the initial agreement you sign. This can be either a fixed fee or a percentage of your outstanding balance.

If your minimum payment is a percentage of your balance, it typically falls in the range of 1% to 5% on average. In cases where the calculation is based on a flat fee, it encompasses all fees and interest due for that month, along with 1 percent of the principal amount owed. The specific method for calculating the minimum payment is clearly defined in the terms and conditions agreed upon when you initially signed up for your credit card. Understanding these terms is crucial for responsible credit card management and avoiding potential penalties or fees.

Pitfalls

While paying the minimum on occasion may not be inherently harmful, it can become a risky habit. Relying on minimum payments can lead to a growing balance due to the interest accrued on the remaining amount and additional charges added to the subsequent month’s statement. If you continue to accumulate charges without making substantial payments, your balance may escalate, and this is often a pathway to debt.

Dependence on minimum payments becomes problematic when it doesn’t contribute to reducing your overall balance, especially if you keep adding new charges to your account. This cycle is a common factor in individuals falling into debt.

Beyond the financial consequences, failing to pay at least the minimum can result in penalty fees, damage to your credit rating, and in more severe cases, it may prompt the credit card company to take legal action to recover the borrowed funds. Responsible credit management involves understanding the potential pitfalls of relying solely on minimum payments and taking proactive measures to address outstanding balances.

Low Interest Credit Cards

While all credit cards come with a minimum payment requirement, the level of concern varies among different cards. If you find yourself relying too heavily on making the minimum payments, you can consider utilizing 0% introductory APR credit cards strategically. By making the minimum monthly payment on these cards, you can take advantage of the 0% interest offer for the remaining account balance over an extended period, often around 21 months or more.

Once the introductory period concludes, you have the option to explore another 0% interest credit card or opt for a low-interest credit card to mitigate interest costs. This approach can be a helpful strategy for managing debt more effectively, allowing you a temporary reprieve from interest charges and providing an opportunity to address your outstanding balance with a more favorable financial arrangement. However, it’s essential to be mindful of the terms and conditions of each credit card and to use these tools responsibly to avoid falling into a cycle of debt.

Recommendation of 0% Interest Credit Cards

Here are a few top 0% interest credit cards that let you borrow money for at least 12 months.

0% Interest for 21 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Citi® Diamond Preferred® Card | 0% on purchases for 12 months and on balance transfers for 21 months. After the intro period ends, the go-to rate of 17.24% - 27.99% (variable) applies. (rates & fees) | $0 |

0% Interest for 18 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Citi Double Cash® Card | 0% on balance transfers for 18 months. After the intro period ends, the go-to rate of 18.24% - 28.24% (variable) applies. (rates & fees) | $0 |

0% Interest for 15 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Chase Freedom Unlimited® | 0% on purchases and balance transfers for 15 months (rates & fees) | $0 |

| Blue Cash Everyday® Card from American Express | 0% on purchases and balance transfers for 15 months. After the intro period ends, the go-to rate of 20.24% - 29.24% variable applies. (rates & fees) | $0 |

| USAA Rate Advantage Credit Card | $0 | |

0% Interest for 12 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Blue Cash Preferred® Card from American Express | 0% on purchases for 12 months. After the intro period ends, the go-to rate of 20.24% - 29.24% variable applies. (rates & fees) | $0 intro annual fee for the first year, then $95. |

Small Business Cards with 0% Interest for 12 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Ink Business Cash® Credit Card | 0% on purchases for 12 months (rates & fees) | $0 |

| Ink Business Unlimited® Credit Card | 0% on purchases for 12 months (rates & fees) | $0 |

| The American Express Blue Business Cash™ Card | 0% on purchases for 12 months from date of account opening. After the intro period ends, the go-to rate of 17.49% - 27.49% variable applies. (rates & fees) | $0 |

| The Blue Business® Plus Credit Card from American Express | 0% on purchases for 12 months from date of account opening. After the intro period ends, the go-to rate of 17.49% - 27.49% variable applies. (rates & fees) | $0 |

0% APR credit cards are great for allowing cardmembers to hold a balance for a long period without accruing any additional fees. They are safer cards to use if you are worried about falling into debt.