Overview

If you are looking for a 0% interest credit card, Wells Fargo Reflect® Card is an ideal no-annual-fee 0% VISA card. It offers 0% interest on purchases and qualifying balance transfers for 21 months from account opening. In addition, it has no annual fee and has low transaction fees for balance transfers. All of the features make Wells Fargo Reflect Card one of the best 0% interest credit cards available for U.S. consumers.

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. 18.24%, 24.74%, or 29.99% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate, BT fee of 5%, min $5.

- $0 Annual Fee.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

- Intro APR

- 0% on Purchases and qualifying Balance Transfers

- Intro APR Period

- 21 months from account opening

- Annual Fee (rates & fees)

- $0

- Credit Needed

- Excellent / Good

Card Benefits

0% Intro APR

Wells Fargo Reflect Card, formerly Wells Fargo Platinum Visa Card, offers 0% intro APR for 21 months from account opening. You will enjoy 0% interest on purchases and qualifying balance transfers for 21 months from account opening. After the introductory period, the go-to rate of 18.24%, 24.74%, or 29.99% variable applies.

With 0% introductory interest on purchases, you can make expensive purchases now and pay off credit-card balance 21 months later. As long as you make minimum payments shown on your credit-card statements every month, you will not have to pay any interest or fees for 21 long months.

Furthermore, you can have 0% interest on balance transfers made within the first 120 days, which means that you can transfer existing balance of other credit cards to your Wells Fargo Reflect Card. In this way, you can save money on interest fees by paying off current credit-card balance now. And you can then pay no interest for 21 introductory months on the Wells Fargo Reflect Card.

Savings on Balance Transfers

For each balance transfer, there is a one-time transaction fee at 5% of the balance-transfer amount, with a minimum fee of $5. The balance transfer fees of Wells Fargo Reflect Card are among the lowest of balance transfer credit cards.

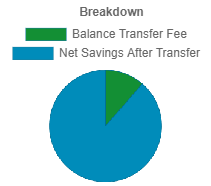

For instance, if you carry a balance of $10,000 on a credit card that has an interest rate of 25%, you can sign up for a Wells Fargo Reflect Card to request a transfer in the first 120 days to save about $3,875. The potential interest fees on the current credit-card balance is about $4,375 for 21 months. And the transaction cost is $500 to do the balance transfer. Therefore, the net savings is about $3,875. You can use our balance transfer calculator to find out how much you can save on balance transfers.

| Potential Interest for 21 months | $4,375.00 |

| Balance Transfer Fee | $500.00 |

| Net Savings | $3,875.00 |

Complimentary Cellular Telephone Protection

Cardholders can enjoy complimentary Cellular Telephone Protection provided by Wells Fargo, which reimburses account holders for damage to or theft of cell phones. Just use your Wells Fargo Reflect Card to pay monthly cell phone bills, and you will get up to $600 of protection against covered damage or theft. It reimburses you for the cost of the repair or replacement of your original cell phone. You can have a maximum benefit limit of $600 per claim, less a $25 deductible, and $1,200 per 12 month period.

Fees

Wells Fargo Reflect Card has no annual fee, which means there is no cost to keep the card. But for purchases that you make when you travel abroad, there are 3% foreign transaction fees. It is typical for no-annual-fee credit cards to have 3% surcharges on foreign purchases.

Required Credit Rating

Wells Fargo Reflect Card is a 0% APR card for people with good or excellent credit rating. If you have a credit score of 700 or more, you may qualify for the credit card.

Is this the right card for you?

Wells Fargo Reflect Card is best for people to save money with its 0% interest offer for a long introductory period of 21 months. In addition, it has no annual fee and a low transaction fee for balance transfers, which makes it one of the top 0% interest cards. Moreover, card members will receive free Cellular Telephone Protection for damaged or stolen cell phones, up to $600 for repairing or replacing your original cell phone per claim. In conclusion, these benefits make Wells Fargo Reflect Card an ideal 0% credit card to borrow money without worrying about interest fees.

Similar 0% Interest Credit Cards

If you are interested in the Wells Fargo Reflect Card, you may also consider the following 0% interest credit cards with similar benefits.

0% Interest for 18 Months or Longer

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Citi® Diamond Preferred® Card | 0% on purchases for 12 months and on qualifying balance transfers for 21 months (rates & fees) | $0 |

| Citi Double Cash® Card | 0% on balance transfers for 18 months (rates & fees) | $0 |

0% Interest for 15 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Wells Fargo Active Cash® Card | 0% on purchases and qualifying balance transfers for 15 months from account opening (rates & fees) | $0 |

| Bank of America® Customized Cash Rewards credit card | 0% on purchases and qualifying balance transfers for 15 billing cycles. After the intro period ends, the go-to rate of 19.24% - 29.24% variable applies. | $0 |

| Bank of America® Unlimited Cash Rewards credit card | 0% on purchases and qualifying balance transfers for 15 billing cycles. After the intro period ends, the go-to rate of 19.24% - 29.24% variable applies. | $0 |

| Bank of America® Travel Rewards credit card | 0% on purchases and qualifying balance transfers for 15 billing cycles. After the intro period ends, the go-to rate of 19.24% - 29.24% variable applies. | $0 |

| Citi Custom Cash® Card | 0% on purchases and balance transfers for 15 months (rates & fees) | $0 |

| Citi Rewards+® Card | 0% on purchases and balance transfers for 15 months (rates & fees) | $0 |

| Blue Cash Everyday® Card from American Express | 0% on purchases and balance transfers for 15 months (rates & fees) | $0 (rates & fees) |

| Chase Freedom Unlimited® | 0% on purchases and balance transfers for 15 months. After the intro period ends, the go-to rate of 20.49% - 29.24% variable applies. | $0 |

0% Interest for 12 Months

| Credit Card | 0% Introductory Interest | Annual Fee | |

|---|---|---|---|

| Wells Fargo Autograph℠ Card | 0% on purchases for 12 months from account opening (rates & fees) | $0 |

| Blue Cash Preferred® Card from American Express | 0% on purchases for 12 months (rates & fees) | $0 intro annual fee for the first year, then $95. (rates & fees) |

| The American Express Blue Business Cash™ Card | 0% on purchases for 12 months from date of account opening (rates & fees) | $0 (rates & fees) |

| The Blue Business® Plus Credit Card from American Express | 0% on purchases for 12 months from date of account opening (rates & fees) | $0 (rates & fees) |

| Ink Business Unlimited® Credit Card | 0% on purchases for 12 months. After the intro period ends, the go-to rate of 18.49% - 24.49% variable applies. | $0 |

| Ink Business Cash® Credit Card | 0% on purchases for 12 months. After the intro period ends, the go-to rate of 18.49% - 24.49% variable applies. | $0 |