Overview

Citi Strata Premier® Card, issued by our partner Citibank, is a consumer credit card that offers rich bonus and generous rewards on everyday purchases. It not only hands out a bounty of $600 value, which is among the best sign-up bonus rewards of any credit cards, but also offers cardholders 3 rewards points for each dollar spent in grocery, dining, travel, and gas. All of those spending categories are the most common purchases for consumers.

- Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

- Earn 10 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 Points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

Card Benefits

Sign-up Bonus

If you spend $4,000 or more in purchases on the credit card within your first 3 months of becoming a card member, you will receive a bonus of 60,000 points, which can be redeemed for $600 in cash rewards or gift cards at thankyou.com. Earning the bonus of $600 value is like receiving a 15% discount on your first $4,000 in purchases, which is an easy way to put more cash rewards back in your pocket. Those applicants who recently received a new account bonus for a Citi Premier or Citi Strata Premier Card account in the past 48 months will not be eligible for the 60,000 points bonus rewards.

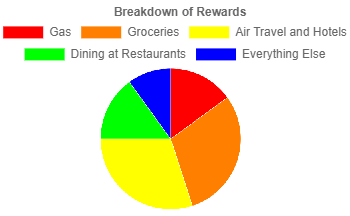

How to Earn Rewards

You will earn 10 points per $1 spent on hotels, car rentals, and attractions booked on CitiTravel.com. You will also earn 3 ThankYou Points for every dollar you spend at supermarkets, restaurants, gas stations or EV charging stations, airlines, and other hotels. For every dollar you spend on all other purchases, you will also earn 1 point.

For instance, if you spend $5,000 on gas, $10,000 on dining out, $10,000 on groceries, $10,000 on travel, and $10,000 on everything else in a year, you will receive 115,000 ThankYou rewards points, redeemable for $1,000 in cash rewards. You can use our rewards calculator to find out how many rewards points you may receive.

| Spending Category | Spending | Rewards Points | Rewards Value |

|---|---|---|---|

| Gas | $5,000 | 15,000 | $150 |

| Groceries | $10,000 | 30,000 | $300 |

| Air Travel and Hotels | $10,000 | 30,000 | $300 |

| Dining at Restaurants | $10,000 | 30,000 | $150 |

| Everything Else | $10,000 | 10,000 | $100 |

| Total | $45,000 | 115,000 | $1,150 |

How to Redeem Rewards

Points can be redeemed for cash rewards or statement credit, gift cards, travel, or merchandise. Redemption for cash rewards starts at 500 points for $5. When you use points to redeem for gift cards, each point is worth 1 cent, which means that 100 points equals $1 in redemption value. Redemption for gift cards starts at 2,500 points for a $25 gift card. There are a wide variety of store gift cards that you can choose from at thankyou.com, such as Target, Home Depot, Lowe’s, Macy’s, GAP, Old Navy, Sephora, Legal Sea Foods, Red Lobster, Chili’s, etc. You can easily redeem points for gift cards of your favorite retail stores or restaurants.

$100 Annual Hotel Savings Benefit

Once per calendar year, the primary cardmember can book a hotel stay of $500 or more through CitiTravel.com and enjoy $100 off the hotel stay. To receive the $100 annual hotel savings, you must pre-pay for your complete stay with your Citi Strata Premier Card, ThankYou Points, or a combination thereof. If you choose to use the benefit, the $100 annual hotel savings will be applied at the time of hotel reservation.

Additional Information

Fees

This credit card has an annual fee of $95. It has no foreign transaction fees on purchases that you make in foreign countries.

Required Credit Rating

The Citi Strata Premier Card is for people with good or excellent credit scores. If you have a FICO credit score of 700 or above, you may be eligible for the card offer.

Is this the right card for you?

If you are looking for a credit card with great bonus and rewards on everyday purchases, the Citi Strata Premier® Card is one of the best credit cards for that purpose. You can earn a generous bonus of 60,000 points points, redeemable for $600, and 3X rewards on purchases on some of your most frequent purchases such as grocery, dining, travel, gas. In addition, this credit card charges no foreign transaction fees. Although the Citi Strata Premier® Card has a moderate annual fee, its value has far outweighed the cost of the annual fee.

Similar Credit Cards with Bonus Rewards

If you are interested in the Citi Strata Premier® Card, you may also consider the following credit cards with similar benefits.

Credit Card Bonus valued at $500 or More

| Credit Card | Bonus | Annual Fee | |

|---|---|---|---|

| Chase Sapphire Preferred® Card | 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. | $95 rates & fees |

| Chase Sapphire Reserve® | 100,000 bonus points + $500 Chase Travel promo credit after you spend $5,000 on purchases in the first 3 months from account opening. | $795 rates & fees |

| American Express® Gold Card | $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required. | $325 rates & fees |

| The Platinum Card® from American Express | $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details. | $695 rates & fees |

Credit Card Bonus valued at $250 or $300

| Credit Card | Bonus | Annual Fee | |

|---|---|---|---|

| Blue Cash Preferred® Card from American Express | $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months. | $0 intro annual fee for the first year, then $95. rates & fees |

| Chase Freedom Unlimited® | Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening | $0 rates & fees |

| First Tech Odyssey Rewards™ World Elite Mastercard® | Get 30,000 bonus reward points when you spend at least $3,000 in your first 90 days¹. That's $300 in value! | $0 intro annual fee first year, then $75 thereafter |

| The American Express Blue Business Cash™ Card | $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months. | $0 rates & fees |

| USAA Eagle Navigator® Credit Card | $95 | |

Credit Card Bonus valued at $200

| Credit Card | Bonus | Annual Fee | |

|---|---|---|---|

| Citi Double Cash® Card | $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. | $0 rates & fees |

| Blue Cash Everyday® Card from American Express | $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. | $0 rates & fees |

| Choice Rewards World Mastercard® | 20,000 bonus Rewards Points when you spend $3,000 in the first 60 days | $0 |

| USAA Preferred Cash Rewards Credit Card | $0 | |