Related Topics: bonus

- Welcome Offer: Earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.*

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.*

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.*

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. *Up to $12.95 plus applicable taxes on one membership fee.

- The Business Gold Card comes in three metal designs: Gold, Rose Gold and White Gold. Make your selection when you apply on Americanexpress.com.

- *Terms Apply

- Elevated Welcome Offer: Earn 200,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Business Platinum Card® within the first 3 months of Card Membership.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,550 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card company on the market as of 07/2025.

- See how you can unlock over $3,500 in business and travel value annually after meeting qualifying spend thresholds on the Business Platinum Card. Terms apply.

- Get up to $300 in statement credits semi-annually for up to a total of $600 in statement credits per calendar year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using the Business Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- No Preset Spending Limit: The spending limit on the Business Platinum Card is flexible, so unlike a traditional credit card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment and credit history.

- Make the Business Platinum Card® work even harder for you. Hilton for Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Gift cards are not an eligible purchase. Benefit enrollment required.

- Fly like a pro with a $200 Airline Fee Credit. Select one qualifying airline to receive up to $200 back per year on baggage fees and other incidentals.

- Use the Business Platinum Card and get up to $209 back per calendar year on your CLEAR® Plus Membership (subject to auto-renewal).

- Maximize your time away with Fine Hotels + Resorts through Amex Travel™.

- Enroll and get up to $150 in statement credits on U.S purchases directly with Dell Technologies on the Business Platinum Card and an additional $1,000 statement credit after you spend $5,000 or more on that same Card per calendar year.

- Enroll and get a $250 statement credit after you spend $600 or more on U.S. purchases directly with Adobe per calendar year on the Business Platinum Card.

- Get up to $90 in statement credits quarterly for purchases with Indeed on the Business Platinum Card. That's up to $360 back per year. Enrollment required.

- Get up to $10 in statement credits per month for wireless telephone service purchases made directly with a wireless provider in the U.S. on the Business Platinum Card. That's up to $120 back per year. Enrollment required.

- Enhanced! 2X points on purchases at U.S. construction material & hardware suppliers, electronic goods retailers and software & cloud system providers, and shipping providers, as well as on each eligible purchase of $5,000 or more, up to $2 million of these purchases per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus.

- 5X points on flights and prepaid hotels on AmexTravel.com

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount - all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

- You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount - all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings. You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- With over 1,550 airport lounges - more than any other credit card company on the market* - enjoy the benefits of the Global Lounge Collection®, over $850 of annual value, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass Select membership (enrollment required), and other select partner lounges.* As of 07/2025.

- $200 Uber Cash + $120 Uber One Credit: With the Platinum Card® you can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction. Plus, when you use the Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- $300 Digital Entertainment Credit: Experience the latest shows, news and recipes. Get up to $25 in statement credits each month when you use your Platinum Card® for eligible purchases on Disney+, a Disney+ bundle, ESPN streaming services, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. Enrollment required.

- $600 Hotel Credit: Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the Platinum Card®. *The Hotel Collection requires a minimum two-night stay.

- $400 Resy Credit + Platinum Nights by Resy: Get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at U.S. Resy restaurants. Enrollment required. Plus, with Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you.

- $209 CLEAR+ Credit: CLEAR+ helps get you to your gate faster by using your face to verify you are you at 55+ airports nationwide. You can cover the cost of a CLEAR+ Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR+ with your Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- Start your vacation sooner, and keep it going longer. When you book Fine Hotels + Resorts® through American Express Travel®, enjoy noon check-in, when available, and guaranteed 4PM check-out.

- $300 lululemon Credit: Enjoy up to $75 in statement credits each quarter when you use the Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That's up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit: Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the Platinum Card®.* Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- Whenever you need us, we're here. Our Member Services team will ensure you are taken care of. From lost Card replacement to statement questions, we are available to help 24/7.

- $895 annual fee.

- Terms Apply.

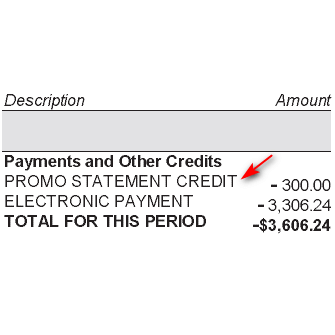

A credit card statement credit is a payment made by a business and posted to your credit card account. Such payment shows up on your monthly credit card statement as a credit, which reduces your account balance. You may receive statement credit for purchase refund, credit card bonus, or redemption of credit card rewards points or miles. Are statement credits better than other forms of cash back? Are statement credits taxable? What credit cards are offering statement credits for bonus or rewards? Continue reading to find the answers.

Do you know that you only need to spend $1000 on a new credit card to get a bonus of $150? Yes, a few credit cards actually offer new card members a rich bonus of $150 after a minimal $1000 is spent on purchases within the first 3 months. This is a whopping 15% cash back on the first $1000 charged to your credit card. In addition, many of these credit cards also offer cash back on purchases, 0% introductory APR, and have no annual fee.

If you would like to earn big rewards on business travel, Bank of America® Business Advantage Travel Rewards World Mastercard® is an ideal no-fee business travel card for you. It offers you an opportunity to earn 3 points for every dollar on travel purchases. In addition, if you are a client of Preferred Rewards for Business, you may get up to a 75% rewards bonus on the base earn of every purchase, which means you may earn up to 2.62 points per dollar on all purchases. Plus, this credit card has no international transaction fees and no annual fee.

Bank of America Business Cash Rewards Credit Card is a small business credit card with great cash rewards. It is a no-annual-fee credit card with $300 bonus and up to 3% cash rewards on select purchases. Big spenders can qualify for the Preferred Rewards for Business to earn up to 5.25% cash back.

After decades in the workforce, retirees finally have freedom to choose how to spend their time. For most seniors, retirement is the ideal time to take on extended travel adventures, including international travel. Most consumer cards charge around 3% of purchase prices on foreign purchases. However, there are a few travel credit cards that waive foreign transaction fees. Just carry these credit cards and use them for purchases abroad, you will not incur the foreign transaction fees. In addition, some credit cards offer lucrative travel rewards or bonus.

Earn rich bonus and rewards on business purchases! Bank of America Business Advantage Cash Rewards offers $300 bonus, 3% cash rewards on purchases in one of spending categories of your choice, and 2% cash back on dining. Bank of America Business Advantage Travel Rewards offers $250 bonus in travel credit, 1.5 points per $1 spent on all purchases, and no foreign transaction fees.