Posts by CardBenefit

Posts by CardBenefit

If you frequently purchase at office supply stores such as Staples, Office Depot & OfficeMax, you may receive 3% cash rewards with business credit cards.

Earn up to 7% rewards on your credit card purchases, which can be redeemed toward the purchase or lease of a new Chevrolet, Buick, GMC or Cadillac vehicle.

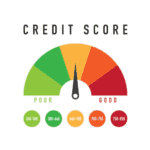

A credit score is a number that is calculated based on your credit history to give lenders a simpler "lend/reject" answer for people who are applying for credit or loans. This number helps the lender identify the level of risk they may be taking if they lend to someone. Your credit score is calculated in a weighted formula. It uses the information in your credit report. The number itself can range from 300 to 900. In most instances, you need to pay to see your own credit scores. But a few credit cards offer their card members free access to credit scores and reports. In addition, some credit monitoring services also offer free credit scores and reports.

Prepaid cards have many uses. Whether you don't like to carry cash, want to pay your bills online, or want to help your children learn to be responsible with money. Check out these prepaid cards that stand out.

The following credit card offers are limited-time or new special offers. Enjoy the rewards that are better than before. Hurry up! Limited-time or special offers usually do not last long.

A gift card is issued by retailers or banks to be used as an alternative to a gift. Gift cards have become increasingly popular because they relieve the donor of selecting a specific gift. The recipient of the gift card can use it at his or her discretion. Find the best gift cards for your occasion: Amazon, VISA gift cards, American Express gift cards, or gift cards from many popular retailers.

The best cash back credit cards offer cash rewards of 2% on all purchases or 3% on select spending categories. Some cards offer cash bonus of $300. Apply!

Save money with the savings and checking offers of 1.55% on high yield savings accounts and $300 bonus. All bank accounts are FDIC insured.

See if you can be pre-qualified for credit cards - it uses a soft credit inquiry that does not appear on credit report, which will not harm credit score.