Overview

If you’re seeking substantial rewards from your credit card, you may sign up for the Wells Fargo Autograph℠ Card. As the latest inclusion in Wells Fargo’s array of consumer credit cards, this card proves to be a valuable choice for those desiring an everyday rewards card. With no annual fee, it presents an attractive option for budget-conscious individuals. The card offers commendable points accrual rates for dining, gasoline, travel, and transportation expenses. Additionally, the Wells Fargo Autograph Card provides a noteworthy sign-up bonus, enhancing its appeal as a rewarding credit card option. Read on for our in-depth review and analysis of the card.

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Intro APR

- 0% on Purchases

- Intro APR Period

- 12 months from account opening

- Annual Fee (rates & fees)

- $0

- Credit Needed

- Excellent, Good

Card Benefits

Sign-up Bonus

After spending $1,000 within the first three months of opening your account, you qualify for a welcome bonus of 20,000 points. When these points are redeemed, the bonus equates to $200. This welcome offer serves as a noteworthy incentive, providing a 20% reward on the initial $1,000 in purchases made during the first three months. The bonus will be credited to your account within one to two billing periods after you have met the qualifying criteria.

How to Earn Rewards with Wells Fargo Autograph

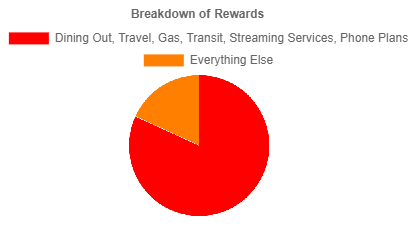

Wells Fargo Autograph Card provides a lucrative 3X rewards system for a range of common purchases. You can earn 3 points for every dollar spent on various essentials, including dining expenses at restaurants, travel costs, gas purchases, transit, phone plans, and popular streaming services. Additionally, you’ll accrue 1 point for each dollar spent on all other purchases.

What sets this card apart is its exceptional combination of 3X rewards across these everyday categories. Notably, the Autograph Card stands out as possibly the only rewards card offering 3X points simultaneously in such popular and diverse spending areas. The inclusion of phone plans as a distinct and valuable bonus category is especially noteworthy, considering that some families spend as much on phone plans as they do on dining out. Another advantage is the simplicity of not having to monitor or enroll in rotating categories, as these 3X rewards are applicable throughout the entire year.

An Example Calculation of Rewards

To illustrate, suppose you spend $18,000 on purchases eligible for 3X rewards and $12,000 on all other expenses within a year. In this scenario, you would accumulate a total of 66,000 rewards points. When redeemed, these points translate into $660 in cash back for the entire year. Utilizing our credit card rewards calculator can help you determine the potential rewards you might receive based on your specific spending patterns.

| Spending Category | Spending | Cash Redemption Value | Net Spending (after Redemption for Cash Rewards) |

|---|---|---|---|

| 3X Rewards: Dining Out, Travel, Gas, Transit, Streaming Services, Phone Plans | $18,000.00 | $540.00 | $17,460.00 |

| Everything Else | $12,000.00 | $120.00 | $11,880.00 |

| Total | $30,000.00 | $660.00 | $29,340.00 |

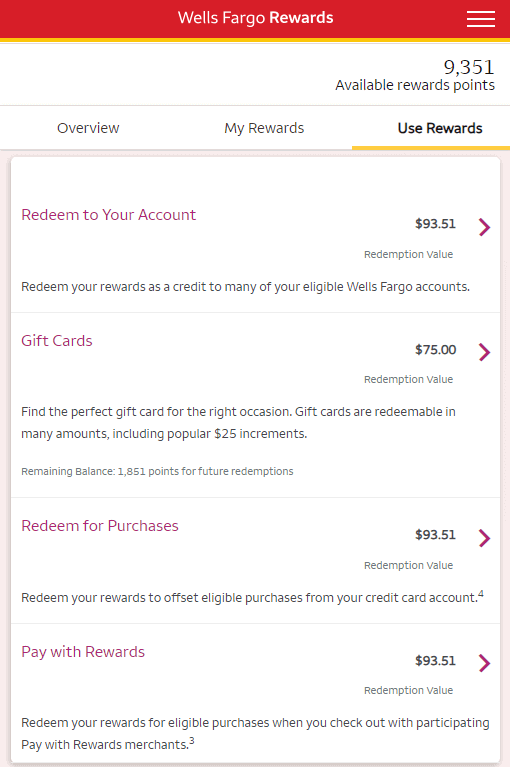

How to Redeem Wells Fargo Rewards

You can redeem your Wells Fargo rewards points in a variety of ways, including statement credit, gift cards, travel, etc. To redeem points, simply log in to your online Wells Fargo credit card account and click the “Wells Fargo Rewards” link. Your rewards points is valued at a rate of one cent per point.

When redeeming points for statement credits, you may redeem up to the full value of your rewards. And you can receive the credit to a Wells Fargo account of yours, such as credit card, checking account, and mortgage. Alternatively, you may use rewards points to pay for purchases, such as flights, hotels, merchandises, etc. Similar to statement credits, you may use up to the full amount of your rewards points when redeeming for purchases.

You may also redeem points for gift cards of your favorite stores, including Amazon, Apple, Home Depot, etc. Gift cards are available in increments of $25, equivalent to increments of 2,500 rewards points. As an incentive, Wells Fargo sometimes runs limited time offers to give you 10% off on select gift cards. This would allow you to redeem every 2,250 points for a $25 gift card. As of November 2023, over a dozen shopping gift cards are available at 10% discount, including Apple, Home Depot, Macy’s, McDonald’s, etc.

For example, if you have 9,351 rewards points, you can redeem all of the points for $93.51 in statement credits to post to a qualifying Wells Fargo account. On the other hand, if you choose gift cards, you may redeem 7,500 points for $75 gift cards, leaving 1,851 points in your account. But if you choose those gift cards with 10% discount, you can actually receive $100 gift cards by using only 9,000 points and still keeping 351 points.

Travel Benefits

No Foreign Transaction Fees

Because there are no foreign transaction fees with Wells Fargo Autograph Card, it is a great payment card for international travel. This card could help you save money while you are on vacation since these fees typically account for around 3% of international purchases.

Rental Car Coverage

Wells Fargo Autograph Card will cover any loss or damage to your rental car, up to $50,000, provided you charge the whole cost of the rental car to the card and refuse the rental company’s insurance. It’s crucial to keep in mind, however, that this coverage is secondary to your insurance policy in the United States, which means that it won’t begin to pay out until after your primary auto insurance has been used. Outside the United States, where this benefit is available, the coverage is primary even if you have another insurance policy.

Roadside Assistance

Wells Fargo Autograph Card also provides its card members with Roadside Dispatch, a pay-per-use roadside assistance program. For a set price per call, you will have access to roadside assistance services such as towing, tire changing, jump starting, lockout service, fuel delivery, winching. It gives you security and convenience wherever your travels take you.

Additional Perks

Cell phone protection

You can get up to $600 in cell phone protection if you use Wells Fargo Autograph Card to pay your monthly cell phone bill. It has a $25 deductible and covers both theft and damage to cell phones.

24/7 Visa Signature Concierge service

Wells Fargo Autograph Card comes with 24/7 Visa Signature Concierge, allowing its cardholders to access a multitude of services. Whether you’re looking for tickets to premier sports and entertainment events, planning travel arrangements, or making dinner reservations, the concierge service is at your disposal to streamline these tasks and more. You can enjoy the convenience of a dedicated service ready to assist you around the clock.

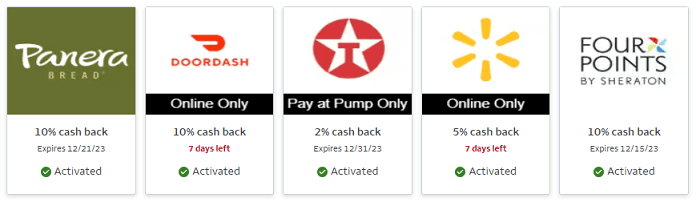

My Wells Fargo Deals

You can also explore personalized deals through My Wells Fargo Deals and unlock exclusive offers from a range of merchants. This convenient platform provides tailored deals that enable you to earn cash back as an account credit when you use Wells Fargo Autograph Card for shopping, dining, or enjoying various experiences. For example, you may get 10% cash back from Panera Bread, Doordash, Four Points hotels by Marriott, 5% cash back from Walmart, 2% cash back from Texaco.

Complementary FICO Score and Credit Monitoring

Wells Fargo Autograph Card also provides complimentary Credit Close-Up, a tool that equips you with the knowledge to comprehend and monitor your FICO Score. By enrolling, you gain access to monthly FICO Score updates and personalized credit insights. This valuable service is complimentary for Wells Fargo Online customers, and rest assured, utilizing it will not have a negative impact on your credit score.

Fees and 0% APR

Wells Fargo Autograph Card has no annual fee and no foreign transaction fees, making it a perfect card to keep without the burden of cost. Furthermore, it offers 0% introductory APR on purchases for 12 months from account opening after account opening. After the intro period ends, the go-to rate of 20.24%, 25.24%, or 29.99% Variable applies.

Required Credit Rating

Wells Fargo Autograph Card is tailored for customers with excellent or good credit. When applying, it’s recommended to have a FICO Score of at least 700. Your credit score is among the various factors considered during the application process.

Is Wells Fargo Autograph Card the right card for you?

If you’re in search of a dependable credit card without an annual fee that provides substantial rewards for everyday purchases, consider obtaining Wells Fargo Autograph Card. The attractive features, including the earning rate, welcome bonus, numerous travel benefits and perks, along with the low introductory APR on purchases, collectively enhance the appeal of this credit card offer.

Similar Rewards Credit Cards

If you are interested in Wells Fargo Autograph Card, you may also consider a few other credit cards with similar benefits.

Travel Rewards Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| Citi Premier® Card | $95 rates & fees | |

| Chase Sapphire Preferred® Card | $95 | |

| Bank of America® Premium Rewards® credit card | $95 | |

Restaurant Rewards Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| Chase Freedom Unlimited® | $0 | |

| Costco Anywhere Visa® Card by Citi | $0 rates & fees | |

| Ink Business Cash® Credit Card | $0 | |

Gas Rewards Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| Bank of America® Customized Cash Rewards credit card | $0 | |

| Citi Rewards+® Card | $0 rates & fees | |

| Citi Custom Cash® Card | $0 rates & fees | |

No Annual Fee Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| Wells Fargo Active Cash® Card | $0 rates & fees | |

| Bank of America® Travel Rewards credit card | $0 | |

| Citi Double Cash® Card | $0 rates & fees | |